99Employee brings solutions related to employee HRMS matters along with employee personal finance involved with Life & General Insurance (Health) and Banking by providing pin to pin clarification on personal investment options, so do check all the information and get the clarity to raise your voice & investment…

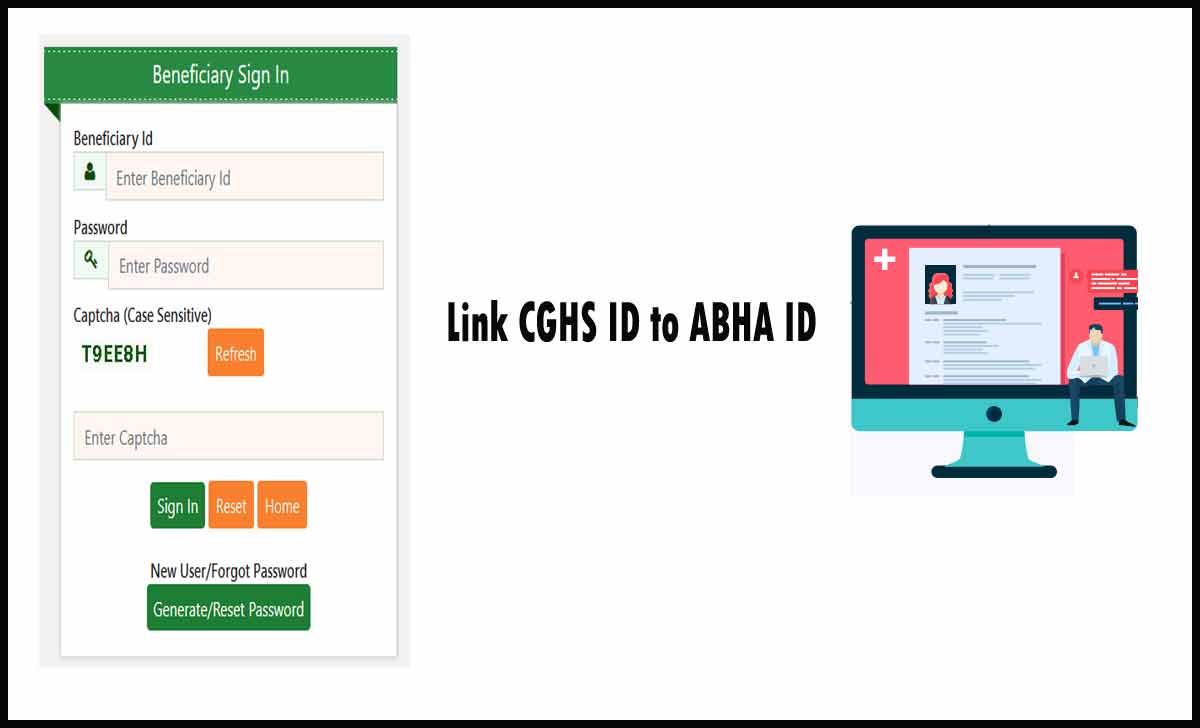

- Link CGHS ID to ABHA ID (Ayushman Bharat Health Account) OnlineIn India, the Ministry of Health and Family Welfare mandated linking the Central Government Health Scheme (CGHS) beneficiary ID with the Ayushman Bharat Health Account (ABHA) ID with effect

- Bank Salary Structure for Workmen and Officer Pay Scale as per 12 BPS and 9th Joint NoteHere is the new Bank pay scale with revised salary structure for Bank employee in India as per the 12th Bipartite Settlement for workmen, Check bank salary for freshers,

- Malabar Gold and Diamonds Scheme Online PaymentMalabar Gold and Diamonds provides scheme with online payment of subscription Remittance, Advance Purchase Plan payments, sales, order advance, others, Dhanteras advance bookings and we will discuss all these

As employees are key behind the working of an organization, the employee related matters are attended by every company to protect the labor law and organize the proceeding and here in 99employee portal.

You may find the process to generate the payslip like RESS Salary Slip and other each company pay slip along with what are the new pay scales allotted in each department and how to assist under employee related offer letters, contracts, dispute and litigation’s are under employee related matters. It can be directly termed as a matter relating to a member of a group or individual and their term of employment or collaboration to their employer.

Dearness Allowance (PSU & Central Government)

Dearness Allowance is calculated based on the employee basic salary which gets increased by the announcement by government, where IDA Rates of PSU employee and CDA rates Central Government is paid by the organizations to its employees and pensioners to offset the inflation impact.

To cope up with the increasing prices of commodities this Dearness Allowance is added to ounces salary, and this gets added with basic salary and HRA to increase the net worth of employee Net salary,a nd the allowance is a varying amount which always gets increasing and this is different for state and central government and PSU employees.

The amount of DA is added on a quarterly and half yearly basis and most importantly based on any festival celebration or union budget the Dearness Allowance always tends to increase by fewer percentages and in 99employee portal you may find the updated DA rates and the history.

- AICPIN for JANUARY 2024 – Updated Consumer Price IndexFind current month AICPIN January 2024 for All India Consumer Price Index Number released on 29.02.2024, Check AICPIN table for

- Maharashtra Dearness Allowance Rates for EmployeeNew PRC applicable Dearness allowance Rates for Maharashtra employee updated as on date from beginning. Check the DA rates applicable

- Chandigarh Employee DA Rates – Updated New ChartChandigarh Employee DA Rates for UT State government employees and retired employees, will be increased with a value as mentioned.

Employee Provident Fund

EPF is a scheme to provide monetary benefit to all employees after their retirement, and it is applicable for both central and state government employees along with private sector employees as well. As per the rules and regulations of Indian government, any company which has more than 20 employees must get themselves registered to EPFO.

Through this an Employee EPF account is linked and their monthly contribution gets added, and the monthly contribution from employees is equally contributed by the employer as well, where the amount collected is added into EPF UAN account, which is uniquely assigned for every employee.

If an employee leaves a company, then this active EPF account will be taken over by a new company, and thus, one employee will have only one EPF account which is meant to add a huge amount for retirement, where the employees can merge their dual EPF to one to make their funds added to one single account.

- Link Aadhaar to EPF UAN Online without Login & Check StatusLink EPF account with Aadhaar Online and submit EPFO eKYC. Check EPF Aadhaar Link status online and the process for

- UAN Card Download or Print Pdf at EPFO Member PortalUAN card download available in online as pdf. Print UAN card directly online at any time for EPFO account holders.

- EPFO WhatsApp Helpline Number for EPF Account EnquiryHow can i contact EPFO by Whatsapp? To resolve this query, We update all EPF Whatsapp helpline number related to

General Insurance

General Insurance is also termed as non-life insurance policies which include automobile, homeowners’ policies and provide cover accordingly. Insurance contacts which do not include life insurance, or its related ambit are considered as General Insurance.

Fire, Marine, Motor, Accident, Non-life General Insurance are some different types of General Insurance which are available, and If you’re out for some vacation and your belongings like car, jewellery, home and other valuable items get involved in fire or natural climate changes, then this type of accident cover is considered under General Insurance.

Keeping safety as prime concern and to avoid any mess due to loss during any natural or third-party negligence are covered under General Insurance, and there are numerous Banks and other Insurance companies which offer best General Insurance based on their Add-ons premium amount.

- BSNL Employee Health Insurance – Best Medical InsuranceList of complete details for BSNL Employee Health Insurance 2024 available | Find the difference between BSNL MRS and Employee

- Care Heart Health Insurance Claim Form Pdf OnlineCare Heart does come with life Heart care options which cover all expenses during insured hospitalization on submission of claim

- IRCTC Travel Insurance New Benefits for Complete TravelThe IRCTC Travel insurance is all about the passenger and the safety of their belongings, and there is no disadvantage

Gold & Silver Rates

The rate of Gold and Silver changes daily and 99employee updates the live and daily / monthly prices of Gold rate which can be checked from the stock exchange, As the rates of Gold and Silver are directly proportional to international market changes regarding Oil export or government change, thus the rate of these essential commodities does change accordingly with any changes in the market, so it is essential to check the gold rate before going to buy.

As it is seen that Gold and Silver rates do change to a high extent during festival season and holiday seasons, and It is always best to check the prices before going to buy these products as they change in either direction, While selling Gold or Silver in the market, it is best to check the current price and if you’re getting a good rate of exchange then you can move ahead for exchange.

- HDFC Bank Share Price, Target, FV, Bonus, Split HistoryPresenting complete details on HDFC Bank Share Price with live today market update, Watch HDFC Bank bonus history, share price

- Nickel Price History as Per Price ChartOver the time Nickel Price has not increased much is why it is highly found deposited and mined to proper

- Palladium Price 2024 HistoryPalladium is a global mineral wealth because it is traded not just across a few nations but across the globe

Car Insurance

Buying a Car is a major goal for everyone and thus this also takes a huge investment to progress, and it is unknown when you drive your heavy budget car on the road, what is going to happen. Thus, it is always recommended to have a Car insurance for compulsory use, and as per the guidelines of Indian Road Law, a Newly bought Car must be registered with third party liability insurance.

Health Insurance

In the growing world, every individual has got their personal responsibilities and liabilities, and thus, any effect to them in terms of medical or any accident will be covered under Health Insurance where it is an insurance coverage which pays for surgical, medical, dental or any expenses during medical emergencies.

In case of utmost times of individuals and for parents holding Health Insurance cover will allow their family for cashless benefits and doesn’t keep a burden on their family.

Having a Health Insurance is best in this running world as you don’t know what is going to happen, and this helps policyholders bear the portion of risk by paying the medical costs and other agreed terms as per the Health Insurance policy, so get the best medical care during your emergency period without disturbing your finances, Here in 99employee portal, you will find all the relevant solutions and which is best.

Calculator (Insurance, PPF, NSC, Lumpsum, SWP and more)

Calculation of premium amount along with checking the maturity amount collected in terms of PPF is done through PPF calculator, and as such to calculate Insurance, National Saving Certificate, Lumpsum, Systematic Withdrawal Plan and more premium amount, a calculator is most important.

Using a calculator allows you to check your total amount being saved by the end of maturity period, and also, the EMI amount to be paid for this can be calculated based on your savings accumulated.

In this investment trending life, a calculator assigned to any category will allow you to plan your expense from the savings and allow you to invest the correct amount, so based on the calculated amount, you can move to invest your savings in insurance or PPF or such without any hesitation.

Central Government Health Scheme

CGHS is a Special health Scheme provided by Government of India to its Government employees through a wellness centre which was referred to as CGHS Dispensaries, polyclinic Allopathic, Ayurveda, Yoga, Homeopathic all medical facilities are provided.

Every government who is eligible to hold CGHS health scheme, will be given an CGHS which allows him to visit the government verified wellness centre and get treated for free, where many major hospitals accept the CGHS Card, which allows a government employee to get treated for the treatment without cash.

A contribution from employee salary will be deducted on a monthly or yearly basis which will be accumulated as a protection plan for emergencies, so check all from 99employee.

- How to Transfer CGHS Card for Employee & PensionersProviding the new process for transfer of CGHS card from one city to another city for pensioners and serving employees.

- Addition or Delete Family Member Name in CGHS CardAddition of family member in CGHS is important, Let you know How an employee or pensioner can add or delete

- CGHS Online Appointment on New Timings to Consult DoctorFind the slot as per your timings and confirm CGHS online appointment to consult the specialist doctor in any of

Customer Care

99employee provides each customer care contacts which is a workflow designed to best satisfy and provide delightful interaction to their customers, and to represent a brand which provide good service to customers a full defined customer care is put up, and customer Experience can also be termed as Customer care which is far different than Customer Service or Customer support.

A Customer care provides a 24*7 representation of their brand and work to bring their customers with always happy smiles, and every company or Government organization which has its products out in the market does assign a special department for customer care to get Customer Loyalty.

This tends to increase the money which customers spend on their business and thus provide a service which allows customers to buy more frequently and generating positive word of mouth about the business and the service to the citizens or employees.

Credit Card

A Credit card is a plastic card issued by a Financial Company which lends the card holders to borrow an amount whenever needed, and this amount to be paid for any essential needs can be borrowed and since then a limited time bond is given to repay the amount, where an interest free amount that the bank allows their customer to borrow which needs to be repaid in limited time.

A debit card is a payment card that deducts money directly from the customer account, and the need to carry cash is eliminated by the use of debit cards, as they are now accepted at all markets and shops. Debit Cards are also referred to as check cards which offer many benefits to their customers.

Every bank based on the CIBIL score of a customer allows them to take their credit card with an initial funded amount, and this amount varies from customer to customer based on their score and thus which can be used anytime using their provided Credit Card.

This Plastic Card relates to Mobile Number to receive OTP for every transaction done and thereby with an PIN for offline transactions, and here 99employee provides the necessary process in each you required.

- JCPenney Credit Card Payment, Card Activation and Phone NumberThe JCPenney Credit Card, issued by Synchrony Bank is a retail credit card offered by JCPenney, a popular department store

- Ulta Credit Card Payment and Customer ServiceSuppose you are a customer of Ulta Beauty, In that case, I am sure you would surely be using their

- CitiBank Credit Card New Login and Payment with Types of CardsTypes of CitiBank Credit Card and their Special Features Citi Rewards Credit Card Citi Cashback Credit Card First Citizen Citi